Blockchain transforming the banking sector

9 min readJan 25th, 2019

Invented back in 2008, the Blockchain technology has proved that it has the power to completely overhaul the operations in many business areas. So much so that there aren’t many imaginable domains that are not already overcoming their legacy challenges thanks to Blockchain-based solutions. Blockchain has an array of characteristics, but not limited to, decentralisation, transparency, security, and immutability. These characteristics, and more, make it an extremely appealing choice for businesses across the world. One such domain that is leading the way in exploring Blockchain and its implementation is the banking sector.

The banking sector is one that is extremely strictly regulated in all jurisdictions, while the bank officials and even the sector representatives are known for their conservative attitudes. But owing to the wide dissemination of blockchain in the past half a decade coupled with the ICO boom has contributed to the fact that many banks management and financial organisation no longer deny the possibilities that Blockchain brings with it. So much so that they’re all set to embrace the powers that come along with a Blockchain implementation.

Large banks have started conducting tests of decentralised asset technologies and implementing the Blockchain technology in their business processes. Further, they are also investing in a number of startups, projects, and researches that will help come up with even better Blockchain-based solutions.

Accenture consulting company, that specialises in strategic planning, conducted a study of various banks. It was found out that more than 50% of all the top level managers admit that the Blockchain technology is surely going to play an unprecedented role in the success of financial firms in a very near future. The analysts at Accenture found out that the world financial sector will save up to $20 billion by 2022 just by implementing Blockchain-based solutions. .

Blockchain: The ultimate panacea for financial firms

Blockchain-based solutions can easily help solve a lot of problems that these banks and financial organisations were traditionally facing. Because of the various characteristics, the Blockchain-based technology comes as an extremely attractive option. Almost as attractive as Linux (because of its transparency) and Skype (owing to the Voice over IP protocol) when they were first brought into existence.

The security that comes with Blockchain-based solutions is something that was always wanted but was difficult to achieve. By providing a high level of safety and security in storing and transmitting data, open and transparent network infrastructure, and a decentralised infrastructure coupled extremely low cost of operations, the Blockchain technology has emerged as the ultimate panacea for banking and financial institutions.

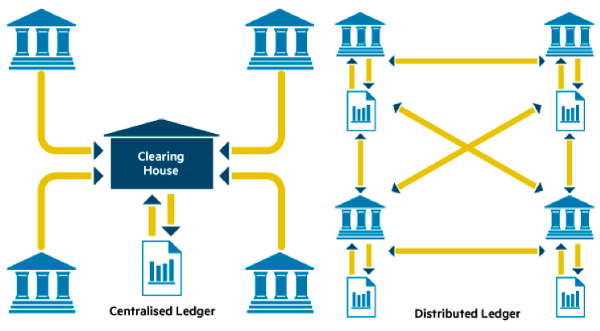

When we talk about credit and financial institutions, they simply cannot carry out work without a number of mediators. This pool of mediators not only adds complexities in terms of operations but also makes the whole process much more expensive. Using Blockchain-based solutions, these institutes will be able to completely eliminate unnecessary mediators - this will result in faster, safer, and cheaper services.

It doesn’t come with any surprise that out of all the industries currently using Blockchain implementations, the financial sector tops the list.

Which solutions are helping banks overcome legacy challenges?

The main outcomes of implementing these Blockchain-based solutions for the financial institutions are the ability to reduce cost and make the transfer faster. The benefits that it provides to cross border payment cannot be overstated either. As of now, the number of days required to process a cross border payment are extremely high. Add to that the deductions in money while it is transferred from one place to the other. Using Ripple or other cryptocurrencies that are based on the Blockchain technology can help reduce the gap of days between payment being made and payment being received.

Another field of Blockchain application for banks and financial institutions is the creation of a client identification system that works on distributed ledger technology. This is extremely useful because all the credit organizations mandatorily perform Know Your Customer while processing any application. It also helps FinTech firms onboard customers quickly and seamlessly. Using Blockchain-based solutions, these firms can enable their users to be identified on a single occasion and store that information securely with access granted to other banks in the system.

Further, the domain of banking and finance is closely related to ensuring deposits and loans. Even in the developed nations, most of these banking operations are often called out for reasons like lack of security and unreliability. A distributed system based on the ledger technology will come in handy for P2P lending. Such a system for loans and deposits will be completely decentralised, and since the deposits are not in control of any one organisation, the system can never really go bankrupt.

Decentralisation is something that will absolutely guarantee stability as well as reliability.Another excellent use case of Blockchain in banking is that in Trade Finance. Using Blockchain-based solutions can drastically reduce processing time, eliminate the use of paper, and help save money - all the while ensuring transparency, trust, and security. By removing bad actors and forcing everyone involved to play fair, these Blockchain-based solutions are completely overhauling Trade FInance.

A subordinate to the Polish Bank Association - The Credit Data Processing Bureau - recorded the credit histories of around 150 million Europeans. A British fintech organisation by the name Billion Group last year received EUR 1 million of investments from the EU last year. They’ve created a unique Blockchain-based solution that allows the bureau to easily process customer data.

The bureau’s management believes that these Blockchain-based solutions and services truly comply with the legal requirements along with the data protection regulation. To add to that, these solutions also meet the needs of industry and increase efficiency. The product offered by the Billion Group is currently being implemented and tested by ten major Polish banks. The management of these banks is pretty confident that it is what the industry needed, and that these Blockchain-based solutions will radically transform the way personal information is stored and transferred between banks and clients, for the better.

One of the representatives of the Billion Group said that the company continues to develop and introduce Blockchain-based solutions not only for better data processing and storing, but also to help operations that involve fiat money. Their target is to revolutionise the way data is managed and store so that users have full control of their personal data, and neither of confidentiality or security is compromised.

Grupo Santander, the largest Spanish banking group and also one of the leaders in the UP, has pioneered the implementation of Blockchain-based solutions in the banking sector. Controlled by the Banco Group, this group has successfully implemented a fully functioning system that goes by the name One Pay FX. This system runs on Blockchain and its primary goal is to use distributed ledgers to optimise payments between Europe and South America.

The Spanish bank has also launched a service aimed solely at accelerating international banking transactions, and thereby reducing the costs that the firms have to incur while processing them. This service runs on Ripple Blockchain - something that is well-known, thanks to its cooperation with American Express, Western Union, and other major players from the banking sector. Santander is also testing and developing a Blockchain solution that’ll help carry out shareholder voting as per the needs of major partners, including Northern Trust, Broadbridge, and JPMorgan Chase.

JPMorgan Chase is a firm believer in the future of Blockchain. So much so that they’ve assigned a separate enterprise - the Quorum division - to study, research, explore, and implement this technology. JPMorgan is continuously testing applications for financial processes and has already issued an annual deposit certificate with a floating rate. This certificate is based on a distributed registry.

Another leading player, Goldman Sachs, actively supports, studies, and promotes distributed registry technology. They have already invested in the Circle cryptocurrency project. Bloomberg reports that the bank intends to become a leader in the use of Blockchain and cryptocurrency among all its Wall Street competitors. For this, they’re creating their own cryptocurrency unit which exclusively deals with digital currency trading operations.

Talking about RBI or the Reserve Bank of India - the governing authority of Indian banks, it has shown an active inclination towards Blockchain and related solutions. The IIDRBT (India’s Institute for Development and Research in Banking Technology) has been actively working on the use of Blockchain for banking systems.

The matter of fact is that it’s not only large banks and institutions that are supporting and thus implementing Blockchain-based solutions. Every firm that operates under the financial or banking sector can use this opportunity to dedicate some time and efforts towards understanding Blockchain-based services and finding out solutions to their problems.

How does the near future look?

The Blockchain technology can have a tremendous impact on the procedures that involve concluding and confirming transactions, optimising assets, and managing cash, among many other business processes that otherwise cost billions of dollars for banks.

These solutions are extremely fast, secure, and transparent than any other system or approach that these institutions have taken in the past. Banking is certainly one of the most promising spheres that is reaping the benefits of Blockchain-based solutions.

Making it possible to extremely reduce the time frames, Blockchain has become accepted and established. Think about the time from a loan application being approved to the actual loan being received, or the time it takes for inter bank or international transfers, and the time for processing, and so on. Using the decentralised Blockchain technology, these firms can help reduce exactly those time frames.

As of today, the Blockchain technology has surpassed the point where it was just a dreamy idea for the banking sector. It is already being successfully implemented, as we discussed earlier, too. The future, too, looks extremely bright when it comes to Blockchain and banking.

The technology will provide banks with speed, efficiency, security, and reduced costs in many of their operations. It’ll not only be a boon for the banking institutes, but also for their end user. Further, looking at the pace at which the Blockchain domain is undergoing research, it’s fair to say that the future surely holds a lot of improved and even more useful use cases for Blockchain in banking.

Connect to us

We, at Minddeft, bring constant technological innovation to your business by leveraging the potential of Blockchain technology.Our expertise lies in Ethereum, Hyperledger, Quorum, Python, React and most popular platforms related Blockchain.

Drop us a line to discuss how can we help you.