Client Retention Rate

Proven Expertise in Asset Tokenization

We have years of expertise in designing and tailoring secure and compliant RWA tokenization platforms for enterprises and investors.

We build RWA tokenization platforms that change tangible and financial assets into digitized tokens in a safe and secure manner. We work together with businesses, asset owners, and RWA tokenization firms to implement safe, legal, and authentic platforms. We provide our clients tokenization services that tend to increase the efficiency and transparency in global markets.

Talk to Our Tokenization Experts

With the help of real-world asset tokenization, we convert the financial and tangible assets into safe digital tokens on the blockchain. This strategic move helps to attract international investors, boost liquid capital, and allow fractional ownership of some assets like commodities, real estate, and equity.

Our asset tokenization services are beneficial for firms looking to streamline ownership, lower day-to-day expenses, and create healthy, rational, and transparent investment ecosystems. Being one of the top asset tokenization development companies, we offer RWA tokenization solutions that fulfill enterprise needs by enhancing security, compliance, and scalability.

We assist you in integrating real assets into the digitized economy while keeping regulatory compliance intact. We build the trust based on our end-to-end tailored services.

Client Retention Rate

Blockchain Networks Integrated

in Tokenized Assets

On-Chain Transactions

Smart Contracts Deployed

Countries Served

As being one of the top asset tokenization development companies, we deliver RWA tokenization services that are the blend of security, compliance, quality, and scalability to help businesses launch different platforms investors can blindly trust.

We tailor structured tokens that align with your asset and regulatory demand while ensuring true market value for each token.

Our team is committed to creating secure and audit-resistant smart contracts, which in turn will automate issuance, transaction workflows, and compliance.

Go live with your own branded RWA tokenization platform with a ready-to-use and fully tailored white-label solution.

![[object Object]](/_next/static/media/RWA-service-04.e6891f23.webp)

We conduct deep-down analysis and audits to ensure your platform meets industry regulatory compliances and investor trust standards.

![[object Object]](/_next/static/media/RWA-service-05.65136521.webp)

We create our platforms in such a way that they will seamlessly integrate with leading blockchains, ensuring scalability and cross-chain compatibility.

![[object Object]](/_next/static/media/sca-service-03.e94b626a.webp)

We avail vigilant monitoring, updates, and enhanced features to keep your tokenization platform ready to deploy for the investors all the time.

Our real world asset tokenization platform is built to handle diverse asset classes, turning everything from tangible property to financial instruments into secure, tradable digital tokens.

Convert residential, commercial, and land holdings into tokens that enable fractional investment and easier global transactions.

Tokenize stocks, bonds, or structured products to create transparent and efficient digital markets for investors.

Back tokens with gold, silver, oil, or agricultural products to simplify trading and provide verifiable asset ownership.

Turn rare artwork or unique collectibles into digital tokens, offering provenance tracking and wider market access.

Create digital models for early-stage investments and private equity funds, giving investors access to liquidity sooner.

Tokenize patents, trademarks, or licensing rights to streamline monetization and automated royalty distribution.

The success of your platform usually depends on your choice of RWA tokenization partner. To provide tokenization platforms tailored and customized for the actual market, Minddeft has a plethora of technical expertise, regulatory knowledge, and practical execution experience from different clients.

We have years of expertise in designing and tailoring secure and compliant RWA tokenization platforms for enterprises and investors.

From fully organized solutions to ready-to-deploy white-label tokenization platforms, we create around your business model and that's too customized.

We ensure that our platforms are built-in with regulatory frameworks to ensure alignment with KYC, AML, legal, and jurisdictional standards.

We create systems that help you grow your business, supporting n number of asset classes and expanding investor bases.

We work as your extended team, ensuring every decision and feature aligns with your business goals and market requirements.

We create our RWA tokenization services to operate across different countries without hassles, enabling you to access multiple international investors and markets.

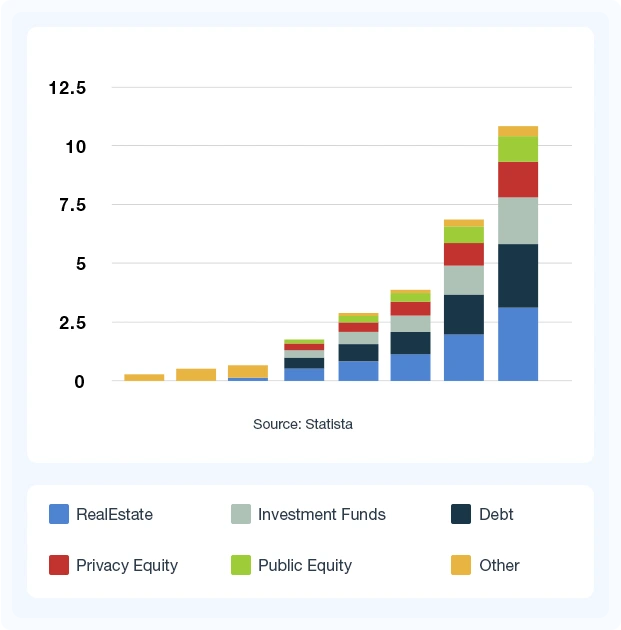

The requirement for secure and liquid investment models is driving real-world asset tokenization from basic concept to large-scale adoption. As companies and investors employ tokenization for various asset classes, the latest industry reports indicate massive growth.

Our asset tokenization platform development services are tailored to assist companies in making entry into this expanding market by providing secure, legal, and investor-ready RWA tokenization approaches and solutions.

We build RWA tokenization platforms with one prioritized goal in mind: turning real assets of your choice into digital products that in turn bring long-term value for your business and your investors.

Convert high-value assets into worth tokens that can be traded or subjected to fractionalization, helping you release capital without losing ownership.

Our ready-to-deploy white-label tokenization platforms let you go to market with investor-ready products without long development timelines.

Every transaction (small to big) is backed by verifiable records, strengthening trust between you and your investors from day one.

Fractional ownership models help to attract both institutional and retail investors with flexible entry points.

Regulatory checks, KYC, and reporting tools are incorporated into the platform, so you stay aligned and in sync without adding manual layers.

Our platforms are designed to grow with your expanding business, supporting new asset classes and markets.

Different assets require different token frameworks. We work with widely accepted token standards to ensure security, interoperability, and regulatory alignment for every RWA tokenization platform we build.

The most common fungible token standard, ERC-20, is perfect for representing divisible assets such as securities or commodities, allowing for seamless integration into exchanges and wallets.

ERC-721 is specifically designed to represent unique, indivisible assets like real estate parcels or rare collectibles, thereby enabling one-of-a-kind token representation.

The ERC-1400 / ERC-3643 standard is specifically designed for security tokens, facilitating controlled transfers, compliance features, and direct management of investor rights within the smart contract.

ERC-1155 is a flexible hybrid standard that supports both fungible and non-fungible tokens, making it ideal for platforms that handle multiple asset types simultaneously.

For clients deploying beyond Ethereum, we support TRC-20 and other chain-specific token frameworks to provide cross-network interoperability.

We create our RWA tokenization platform to adapt to numerous sectors, helping businesses in transforming tangible and financial assets into safe, secure, tradable digital tokens. From property (real-estate) portfolios to carbon credits, we avail solutions that open new market Opportunities and create real business impact.

Enable fragmented or fractional ownership, cross-border investments, and increased liquidity by tokenizing residential and commercial properties.

Digitize financial instruments, align and streamline settlements, and build ready to use platforms for tokenized securities and alternative assets.

We empower creators and related stakeholders with tokenized content rights, NFTs, and transparent royalty distribution models which is lucid and secure as well.

Tokenize legal documents, right to ownership, and contracts to create immutable, verifiable records for secure transactions as per legal requirements.

Turn high-valued automobiles and fleets into tradable digital assets for leasing, investment, and shared ownership models.

Tokenize carbon credits to have transparent tracking, trading, and compliance in the growing market for sustainable assets in the long run.

Every RWA project needs a clear and planned roadmap. Our process and expertise keep your platform secure, compliant, and market-ready while making sure every step is transparent, compliant, and collaborative.

![[object Object]](/_next/static/media/ground-reality.3cc869ef.webp)

We begin by gathering requirements, understanding your asset classes, compliance requirements, and business goals. Together, we define the apt token model and tailored platform structure.

Our team creates a secure and safe system design, mapping out smart contracts, transparent and compliant layers, and integrations to ensure your platform performs as per the industry and market needs.

We build each and every module with security-first coding practices, followed by rigorous functional unit testing and system integration testing for performance, compliance, and audit readiness.

Your structured platform is deployed on the blockchain of your choice, with seamless integration into your existing systems and investor workflows.

We train and guide your team to manage and scale the platform and provide ongoing support to operate and adapt to market and upcoming regulatory changes.

Token issuance is only one aspect of a robust tokenization platform. For tokenized assets to perform in the real world, enough readiness of market infrastructure, security, and compliance are required. Enterprise-grade standards that overlook the complete lifecycle of digital asset tokenization, from structuring and planning to secondary trading, are used in the construction of our RWA tokenization solutions.

The creation and distribution of asset-backed tokens are overseen by the offering manager. It ensures that every issuance is appropriately structured, meets the legal requirements, and boosts your investment strategy.

The Compliance Engine's integrated KYC, AML, and accreditation checks and balances preserve regulatory coherence across several jurisdictions, accelerating the onboarding process while safeguarding investors' interests.

A secure environment and platform where tokenized assets can be enlisted, traded, exchanged, and transferred with full transparency and accountability.

The highly secured process of converting physical assets into digital tokens is managed by the tokenization agent, who also ensures the tokens are connected to ownership records and validated against underlying data.

Clear pedigree with a chain of ownership is ensured, and legal obstruction is reduced by the Transfer Registry's immutable, real-time record of token ownership changes.

By ensuring asset transfers across the blockchain network, the Validator Network guarantees transaction authenticity, upholding security, integrity and confidence throughout.

Operational delays are eradicated with time in hand and less manual intervention is needed when tasks like payouts, voting rights, and compliance triggers are automated effectively.

It takes more than just technology to launch a RWA tokenization platform. Investors trust your platform because of compliance and regulatory alignment, which also protects your company. Our staff assists you in navigating the legal frameworks required to safely and securely introduce tokenized assets to the market.

We help you understand the legal landscape for tokenizing assets in your target markets and jurisdictions.

Our platforms are built with KYC, AML, and reporting features integrated from the ground up, so compliance is part of the system, not an afterthought.

Smart contracts and ownership records are structured to align with securities and asset management laws.

As regulations evolve, we provide continuous guidance to keep your tokenization platform aligned with new rules and best practices.

Your Success, Our Pride

The process of turning tangible or monetary assets, such as stocks, commodities, or real estate, into safe digital tokens on a blockchain is known as "real world asset tokenization." These tokens preserve compliance and transparency while enabling fractional ownership, simpler transfers, and increased liquidity.

Our asset tokenization services offer safe, legal platforms that enable you to access new funding, connect with international investors, and handle assets in a transparent manner. We create tokenization solutions that align with your sector, legal requirements, and long-range corporate objectives.

Yes, you can introduce investor-ready RWA tokenization solutions under your own brand using our fully customizable white label tokenization platforms. These platforms are designed for smooth integration, scalability, and compliance.

Real estate, financial instruments, commodities, intellectual property, private equity, and collectibles are just a few of the many assets that our RWA tokenization solutions can handle. We develop asset tokenization systems that are customized to meet the unique needs of every asset class.

The scope and features needed determine the timeline. You can launch a fully functional RWA platform in a matter of weeks with our white label tokenization solutions. We collaborate closely with you to define and deliver custom tokenization platform development within your business timeline.

Our platforms have reporting, AML, and KYC frameworks integrated into their design. We collaborate with your legal team and incorporate jurisdiction-specific regulations to ensure that the tokenization solution satisfies all legal requirements.

Stay updated with the latest trends in blockchain and decentralization

We've helped everyone from founders with an idea to enterprises rolling out global platforms. If you're ready to explore, we're ready to listen.

We've been building blockchain products that people actually use.

Real launches, real users, real outcomes.

Most of our clients stay with us because we deliver.

A tight crew of engineers, architects, and product experts.