What is RWA Tokenization? A Beginner's Guide to Tokenizing Real-World Assets

8 min readSummary

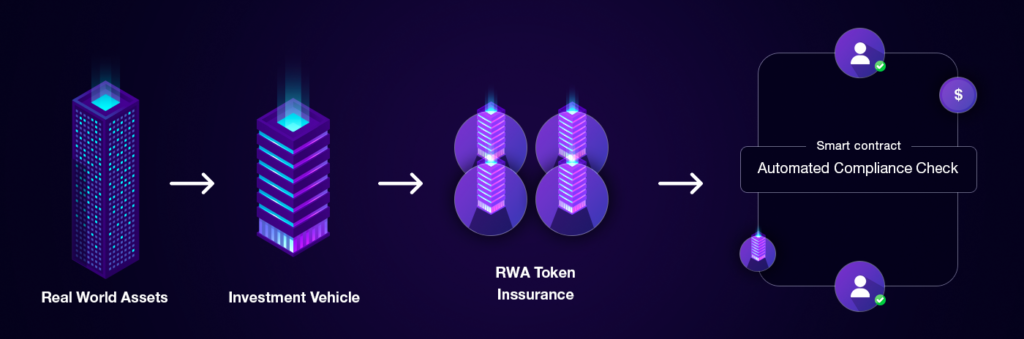

Real-world asset (RWA) tokenization is transforming how we own and trade traditional assets by converting them into digital tokens on a blockchain. This process enhances liquidity, accessibility, and transparency while enabling fractional ownership of valuable assets like real estate, art, and commodities. By leveraging blockchain technology, smart contracts, and decentralized platforms, RWA tokenization simplifies asset trading and reduces intermediary involvement. In this guide, we explore how RWA tokenization works, its benefits, real-world applications, and key considerations for investors and asset owners.

Introduction

Tokenizing real-world assets (RWA) is a massive potential in the blockchain industry, with a possible market size reaching trillions of dollars by 2030. Tokenized real-world assets (RWAs) are becoming a popular part of the digital asset market. Many projects are now trying to tokenize different types of assets, like money, goods, real estate, and more.

Tokenizing real-world assets (RWAs) is changing the way we view ownership and investment in traditional assets. RWA tokenization connects physical assets with blockchain technology, creating new opportunities for investors, businesses, and asset owners.

In this article, we have covered what RWA tokenization is: its benefits, the underlying technology, practical applications, and the future of RWA tokenization.

Also read: Top 7 Use Cases of Real-World Asset (RWA) Tokenization

➤ What is Real-World Asset Tokenization?

The term "RWA tokenization" refers to the process of converting rights to physical assets into digital tokens on a blockchain. These tokens show ownership or part ownership of real-world things, like real estate, art, commodities, or company assets. There is a physical asset backing each token, so it's like having a digital certificate of ownership. Blockchain technology makes these transactions secure, transparent, and immutable.

Imagine this: If you have a valuable painting that is worth $1 million, you can break it down into 1,000 digital tokens, with each token valued at $1,000. People can buy, sell, and trade these tokens on different real estate tokenization platforms, which makes the artwork available to more investors.

➤ How RWA Tokenization Works

Tokenization of real-world assets (RWAs) means turning actual or traditional assets into digital tokens on a blockchain. These tokens show ownership or rights to the item, making it easier to access, trade, and keep safe. Here’s a simple description of how RWA tokenization works:

1. Asset Verification and Ownership

The first step in the process is to confirm who owns the asset. This makes sure that the person or organization creating the token for the asset has the rightful ownership of it. Legal documents like property titles, authenticity certificates, or financial agreements are verified. It carry out due diligence and compliance checks to make sure there are no conflicts, debts, or violations of regulations. Creating a clear legal framework helps build trust and ensures legitimacy.

2. Integration with Blockchain

Once verified, the asset's information is moved to a blockchain platform. The selected blockchain, like Ethereum, Binance Smart Chain, or Hyperledger, acts as the base for keeping and handling the tokenized asset. Smart contracts are agreements that can be programmed to automate tasks like transferring ownership, distributing tokens, and sharing revenue. This step makes sure that the asset is transparent, decentralized, and unchangeable.

3. Asset Valuation

The next step is to figure out the asset's value correctly. Skilled appraisers and auditors determine how much an asset is worth by considering market factors, demand, and its basic value. For example, a property might be valued based on where it is, how big it is, and current market trends. Clear valuation makes sure that every token represents a fair share of the asset, increasing investor trust.

4. Token Creation

Tokens are created to represent the asset in a digital form. These tokens may be:

Fungible Tokens (ERC-20): These tokens stand for assets that can be divided, such as shares or commodities.

Non-Fungible Tokens (ERC-721): represent unique assets like art or collectibles.

For example, A property valued at $1 million can be split into 1,000 tokens, with each token being worth $1,000. The tokens include information that describes who owns them, how they can be transferred, and how they can be used.

5. Tokenized Asset Offering

The next step is a Tokenized Asset Offering (TAO) where investors can purchase the tokens. One option is to sell to large investors privately, while another is to sell to the public on platforms such as tZERO or Polymath. Smart contracts manage the sale, making sure that geographic and regulatory rules are followed.

6. Post-Tokenization Transactions

After tokenization, the asset can be traded on blockchain marketplaces. Ownership transfers are recorded in a way that cannot be changed, providing security and transparency. Secondary markets let token holders sell their stakes, which helps make traditionally illiquid assets more liquid.

7. Legal and Regulatory Compliance

During the process, they follow the regulatory frameworks. KYC and AML checks, along with securities compliance and local laws, help confirm legitimacy. This step makes sure that tokenization follows global legal standards.

RWA tokenization changes how we own assets by turning physical items into secure, transparent and shareable digital tokens. This fresh approach makes it easier for everyone to acquire valuable assets, improves trading options, and opens up new ways to invest.

➤ Benefits of RWA Tokenization

Tokenized real-world assets provide many advantages, such as

1. Increased Liquidity

One of the biggest benefits of tokenization is that it makes it easier to buy and sell assets that usually aren't very liquid. Tokenization makes it possible to divide large assets into smaller, tradable parts, and create new opportunities for:

- Partial ownership of expensive assets

- Faster buying and selling processes

- Broader market access

- Reduced transaction costs

2. Improved Accessibility

Tokenization makes it easier for everyone to access valuable assets that were once only available to wealthy individuals or big investors. This process of making things more accessible happens through:

- Reduce the minimum amount needed to invest

- 24/7 trading capability

- Access to global markets

- Reduced intermediary involvement

3. Increase Transparency

By creating a decentralised ledger of all transactions and ownership, blockchain technology offers:

- Verifiable audit trails

- Ownership status tracked in real-time

- Reduced fraud risk

- Increased trust in transactions

4. Fractional Ownership

Tokenization allows assets to be split into smaller parts, meaning that many investors can own a piece of valuable assets, making it easier for more people to get involved.

5. Improve Efficiency

Smart contracts streamline numerous traditional processes, resulting in:

- Streamlined administrative tasks

- Faster settlement times

- Lower transaction costs

- Streamlined compliance procedures

➤ Technological Framework Behind RWA Tokenization

The success of RWA tokenization depends on a few important technological elements:

- Blockchain and Smart Contracts

Blockchain offers a way to record transactions in a decentralized manner, and smart contracts help automate agreements when certain conditions are fulfilled.

- Token Standards

Standards such as ERC-20 for fungible tokens and ERC-721 for non-fungible tokens on Ethereum help maintain consistency and integration across blockchain networks.

- Oracles

These services offer external data to the blockchain, which is important for integrating off-chain information on-chain. This process makes sure that the data related to tokenized assets is trustworthy and accurate.

➤ Real-World Applications of RWA Tokenization

RWA tokenization can be used in many different industries:

● Real Estate

Properties can be divided into tokens, which lets investors own parts of real estate. This makes it easier for more people to invest in properties.

● Art and Collectibles

Artworks and collectibles that are valuable can be divided into tokens, allowing people to own a fraction of them and making it simpler to transfer ownership.

● Precious Metals

Gold and other assets can be turned into tokens, making it easier to trade and own these commodities.

● Debt Instruments

Bonds and other financial instruments can be turned into tokens, making them easier to buy and sell for more investors.

These applications show how tokenization can change traditional asset markets in many ways.

➤ Conclusion

The concept of RWA tokenization has an opportunity to transform asset ownership and investment. Asset owners and investors both will find it appealing because of the improved accessibility, efficiency, and liquidity, regardless of the fact that there are still certain problems. As technology develops and regulations change, we can look forward to continued development and new ideas in this area.

Learning about RWA tokenization is becoming more important for anyone working in business, asset management, or digital finance. If you own assets and want to find new ways to increase their value, or if you're an investor looking for new opportunities, tokenization gives interesting options for how we own and trade assets in the future.

Keep in mind that RWA tokenization can offer big advantages, but it's important to think about the legal, technical, and market challenges involved. To succeed in this industry requires an understanding of both traditional asset markets and the new technology to make RWA tokenization possible.

Hire Industry Experts

Hire Us NowGet started with Minddeft

today

Contact Us NowFrequently Asked Questions

RWA tokenization means turning real-world assets such as real estate, artwork, or commodities into digital tokens that are stored on a blockchain. These tokens show partial ownership or rights to the asset, causing trading to be easier, increasing transparency, and improving liquidity. Using blockchain technology, tokenization creates secure and unaltered records, making it an effective way to give access to assets that are usually hard to trade.

You can turn almost any physical or non-physical asset into a token. Some common examples are real estate, art, precious metals, intellectual property, commodities, and financial instruments like bonds or stocks. Tokenization lets people own parts of valuable assets, making it possible for small buyers to participate. The type of asset and its regulations will decide how the tokenization process works and what is needed.

Blockchain is a foundation for tokenization, giving transparency, security, and efficiency. It offers a decentralized ledger for recording ownership and transactions, keeping them immutable and traceable. Smart contracts make things easier by automating tasks such as issuing tokens, distributing them, and transferring them, which cuts down on the need for middlemen. Blockchain also improves accessibility by allowing the global exchange of tokenized assets on digital marketplaces.

Yes, tokenization is regulated by laws that change based on the type of asset and the location. Lots of tokenized assets are viewed as securities, which means they have to follow securities laws and ensure investor protection. Rules like KYC (Know Your Customer) and AML (Anti-Money Laundering) checks are usually needed to confirm legitimacy. Talking to legal experts is important to understand the complicated rules and regulations.

Tokenization has many advantages, but it also carries risks such as regulatory uncertainties, market volatility, and technological vulnerabilities. Certain sectors may face challenges with compliance due to a lack of suitable legal frameworks. Also, mistakes in smart contracts or issues with the blockchain could impact the safety or performance of tokens. Investors and asset owners should carefully check their options and select trustworthy platforms.