What is Security Token?

6 min readCryptocurrencies have set out to completely disrupt the legacy finance industry. Blockchain-enthusiasts picture an environment where traditional banks and financial systems will be replaced by decentralized digital tokens and cryptocurrencies. However, there is another group of crypt-assets that has until recently been ignored. We’re talking about a class of cryptocurrency that can not only transform these legacy systems but also change the way we look at physical ownership of various assets. We’re talking about security tokens.

From property to shares to commodities - security tokens can easily be one of the most promising and transformative applications of blockchain and digital assets yet. In this piece, we will take a look at security tokens and how they can transform the way we think about asset ownership, and how they pave a way to mass crypto adoption.

What are Security Tokens?

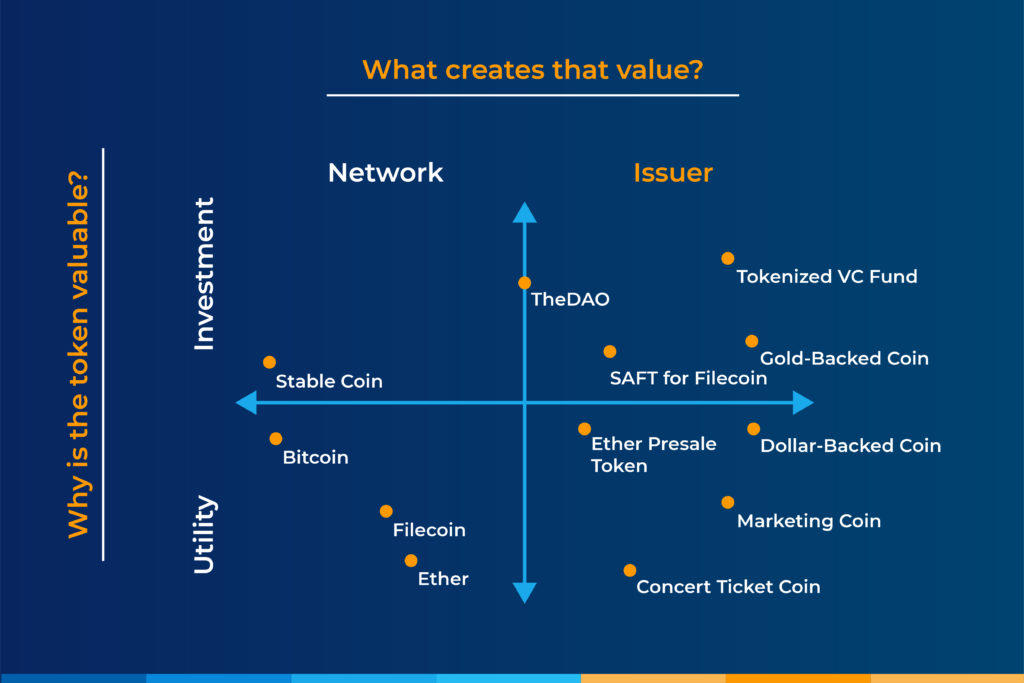

Security Tokens are basically assets that have been tokenized, thereby securitized. In simpler terms, Security Tokens are immutable digital records that establish ownership of the underlying assets. Security Tokens are different from the utility token counterparts in a way that Security Tokens are not developed to be used in an ecosystem. Instead, Security Tokens are developed for investment-related purposes. This allows the holders to partake in future fortunes of the underlying asset.

The best part about Security Tokens is that it offers numerous opportunities for tokenization. For instance, all the forms of traditional securities including bonds, shares, commodities, and more, can be easily tokenized. The list extends to real estate as well as venture capital funds, too.

In essence, you can consider Security Token as a bridge between physically-existing assets and the blockchain world. Security Tokens take the record of ownership of the underlying physical asset and use blockchain-based technology to keep it secure in a digital format; all of this across a large decentralized network. Let’s look at some benefits these Security Tokens offer.

Benefits of Security Tokens

Compared to owning traditional financial assets, Security tokens offer a large array of benefits.

To begin with, there is the ease of trade that comes with these assets. Digital tokens like these can be traded all around the calendar - that is, 24 hours a day, 7 days a week, and 365 days a year. The market for these assets is also global, which allows you to trade your share with anyone around the globe.

Once you’ve determined that you’d like to sell your token, the settlement is also instantaneous. Ownership records get changed immediately on the Blockchain. So, there’s no need to wait for t+3 days for the settlement to happen.

Furthermore, the blockchain market is truly large and expansive, which opens up numerous funding opportunities for companies that are raising finances. All they need to do is tokenize their share and pitch the global community - it’s that simple.

They no longer need to localize the offerings to the investors in their region as blockchain offers literally the entire global market. There’s also no need for numerous middlemen and law agents that invariably inflate costs.

Security tokens also, undeniably, democratize the entire investing process. Instead of “professional investors” getting access to the best deals of Wall Street, Security Tokens allow an average individual to take part in the investing, albeit small amounts.

Another thing to note about Security Tokens is that they are regulated. Given that they are by definition securities, it implies that the SEC will always have jurisdiction over them. As a result of this, the Security Tokens will be more legitimate than all the current ICO offerings that sell under-the-hood securities.

Security Token Projects

There is a whole variety of companies around the globe that are working on projects based on Security Token Offerings.

Out of them, the two most notable are Polymath and tZero.

Polymath is an interesting project that is aiming to create a platform where other companies can tokenize their assets. For better understanding, you can think of it as a Security Token version of Ethereum.

In fact, they have even developed their own standard called the ST20 standard. This platform has Security Token templates that companies can use to begin their process of issuance of ST20 tokens.

Polymath uses smart contracts, legal delegates, and other important services to ensure that your token application is set up to the right standards from all fronts. These standards are required to make sure that the required KYC verification is done before issuing.

The Polymath network has its own ERC20 token that can be used to pay for the resources in their ecosystem. These tokens were released last year and can be purchased on Binance.

The other platform, tZero, is a blockchain subsidiary of Overstock Inc. They have also developed a version of STOs, and have just completed a $134m Initial Coin Offering - that was in the works since December of 2017.

tZero is regulated by the SEC as an Alternative Trading System (ATS) that acts as a medium of exchange for the listing of various security tokens. It also provides a platform that is modular and adaptable for the issuance of securities that are regulated by the SEC.

Concluding thoughts…

While there are many cryptocurrency and blockchain-based projects that struggle with the prospect of scrutiny and security classification that comes with it, there are yet others that are actively embracing it.

Tokenized securities definitely have the potential to entirely transform the financial ecosystem. They can connect large organizations, MSMEs, startups, and other asset originators to a global community of investors.

Moreover, given that these Security Tokens are by and large regulated by the SEC, they come with strong legal backing and legitimacy that is absent in the ICO space. This legitimacy and the trust that comes with it is bound to open up the gates to a whole host of institutional money that has so far been avoiding the space.

Therefore, mass adoption may be closer than you think and Securities Tokens could be the stairway to it all.

Hire Industry Experts

Hire Us NowGet started with Minddeft

today

Contact Us NowFrequently Asked Questions

In simple words, a security token is a digital asset that represents ownership or rights to an underlying investment like equity, real estate, or bonds. Unlike cryptocurrency, security tokens are regulated by financial authorities. They offer benefits to investors such as liquidity, transparency, and fractional ownership while utilizing blockchain technology for efficient transactions.

Security tokens work by digitizing traditional assets and placing them on blockchain networks while making sure transparency, security, and seamless ownership transfer. Each security token represents a portion of an asset, and these tokens can be bought, sold, or even traded like shares on a stock exchange. Security tokens are regulated and ensure compliance with legal frameworks, making them more secure than utility tokens.

Utility tokens provide access to a platform's product or services within the network, while on the other hand, security tokens represent the ownership of a real-world asset or company. Utility tokens focus on functionality within the network, while security tokens are investments, offering financial rights like dividends, voting, and profit sharing.

There are several benefits of security tokens, such as liquidity, fractional ownership, transparency, and compliance with government regulations. They allow for easier and faster trading of traditional liquid assets like real estate or company shares. Blockchain technology ensures security, reduces the cost associated with traditional intermediaries, and creates a more efficient investment process.

There are many assets that can be tokenized as security tokens, including equity in companies, real estate property, bonds, commodities, and venture capital funds. By tokenizing these assets, Issue can offer fractional ownership and enable more liquidity.