How to Evaluate a Metaverse Platform for Your Business

15 min readSummary

Choosing the right metaverse platform is more than picking something that looks cool. Businesses need to know if it can scale, handle users, integrate with existing systems, protect data, and deliver real ROI. This guide breaks down what really matters, compares key options, and gives you practical steps to make confident decisions, so your platform works for your business, not the other way around.

Why Businesses Struggle to Choose the Right Metaverse Platform

Most business leaders don’t struggle because the metaverse is complex.

They struggle because every platform claims to be “enterprise-ready,” but very few actually are.

In internal evaluations, companies often shortlist platforms after watching polished demos or attending virtual walkthroughs. What they don’t see is what happens after 3–6 months of real usage. Industry reports show that nearly 70% of enterprise metaverse pilots fail to move into full deployment, not due to lack of interest, but because the platform cannot scale, integrate, or justify its cost.

The problem starts with how platforms are evaluated. Businesses are pushed to compare visuals, avatar realism, or brand presence, while critical questions stay unanswered:

- Who owns the digital assets once they’re created?

- What happens when user traffic spikes during live events?

- Can this platform connect with existing CRM, ERP, or training systems?

- Are future monetization models locked behind platform rules?

Many platforms are built for experimentation, not operations. They work well for marketing showcases but fall apart when businesses try to run training programs, paid events, or digital commerce at scale. This gap becomes clear only after contracts are signed and budgets are committed.

The real challenge is not choosing a metaverse platform that looks impressive, it’s choosing one that still works when real users, real data, and real revenue are involved.

Define Your Business Objective Before Evaluating Metaverse Platform

Before you look at platforms, vendors, or demos, pause and answer this:

What measurable business result must this metaverse initiative deliver within 12 months?

If the answer is vague, platform evaluation becomes noise.

In real enterprise discussions, projects fail not because the metaverse “didn’t work,” but because one platform was expected to solve multiple, unrelated problems. A system chosen for brand engagement rarely works well for training. A platform picked for internal collaboration often fails at monetization.

Lock in one primary objective

Successful teams commit to one dominant goal at the start:

- Revenue → digital assets, paid access, virtual commerce

- Cost reduction → training, onboarding, travel replacement

- Engagement → customers, partners, community experiences

- Operations → collaboration, simulations, virtual workspaces

This choice is not strategic theory, it’s a filter.

If more than one goal is treated as “primary,” decision-making slows, pilots drag on, and compromises stack up.

Use your objective to remove platforms early

Here’s the important step that everyone skips.

Your objective should disqualify platforms, not justify them.

Ask one direct question:

If this platform cannot support our primary goal within 6–9 months, do we keep it on the list?

Examples:

- Revenue-focused projects require ownership control and pricing freedom

- Training-focused projects require session stability and concurrency

- Engagement-focused projects require low entry friction and device reach

If a platform fails this test, remove it, no redesign, no workaround.

Why leadership teams benefit from this step

Organizations that skip objective clarity often:

- Rebuild after the pilot phase

- Overspend on features they never use

- Or switch vendors mid-project

Teams that define objectives early make faster, cleaner decisions, especially when working with a metaverse development company.

This clarity becomes the reference point for every technical, financial, and governance decision that follows.

Metaverse Platform Foundation: Architecture, Ownership & Compliance

This is where most metaverse evaluations quietly go wrong.

Many platforms look similar on the surface, but their foundation decides whether your project scales cleanly or becomes a long-term liability. If leadership teams don’t examine architecture, ownership, and compliance early, problems surface only after real users and real data are involved.

Centralized vs Decentralized Platforms

This isn’t a philosophical debate. It’s a control and risk question.

- Centralized platforms are faster to launch and easier to manage at the start. But they place rules, upgrades, and sometimes pricing under the platform’s control.

- Decentralized platforms give businesses more autonomy, especially when blockchain is part of the stack, but they demand clearer planning and technical discipline.

The decision point is simple:

Who controls the platform when your use case grows or changes?

Organizations working with a blockchain development services provider often prefer decentralized or hybrid models because they reduce long-term dependency and allow future integrations without rebuilding from scratch.

Asset Ownership: On-Chain vs Platform-Controlled

This is one of the most misunderstood areas, and one of the most expensive mistakes.

Some platforms say you “own” your digital assets, but ownership lives inside their database, not on the blockchain. That means:

- Assets can’t be moved freely

- Monetization rules can change

- Exit options are limited

On-chain ownership, often supported by an nft token development company, ensures assets are verifiable, transferable, and not tied to a single vendor’s system.

Simple test decision-makers should ask:

If we leave this platform, can we take our assets with us, yes or no?

If the answer isn’t clear, ownership is likely platform controlled.

Data Privacy, GDPR & Enterprise Compliance

Compliance is rarely visible in demos, but it becomes critical the moment real users enter the environment.

Key points leaders should confirm:

- Where user data is stored

- Who has access to behavioral and interaction data

- How consent and deletion requests are handled

For EU operations, GDPR alignment isn’t optional. For US enterprises, audit readiness and data governance matter just as much. This is why businesses often rely on metaverse development services that understand regulatory expectations, not just virtual design.

Why this foundation decides everything

Architecture, ownership, and compliance don’t affect visuals, they affect control, risk, and longevity.

Platforms that fail here usually force businesses to compromise later through:

- Restricted monetization

- Limited integrations

- Or costly migrations

Getting this right early creates freedom. Getting it wrong locks decisions in place.

Metaverse Platform Scalability & Performance

This is the point where many metaverse ideas look great on slides and fall apart in the real world.

A metaverse platform isn’t tested by demos. It’s tested on launch day, during campaign spikes, and when real money starts flowing.

Here’s how decision-makers should evaluate it 👇

Concurrent users matter more than total users

Most platforms proudly show registered users. That number means very little.

What you need to ask:

- How many users can be online in the same space at the same time?

- Does performance drop when 200 users turn into 2,000?

- Are worlds sharded automatically, or does congestion kill the experience?

If avatars lag, voices break, or environments freeze, users leave — and they don’t come back.

Revenue traffic is different from user traffic

A metaverse that handles social interaction may still fail under transaction load.

Check:

- Can the platform process high volumes of in-world purchases without delays?

- Are payments synchronous or queued in the background?

- What happens during limited drops, events, or NFT sales?

Revenue moments create traffic spikes. Platforms that can’t handle those moments quietly lose money.

Latency decides whether users stay or bounce

In metaverse environments, milliseconds matter.

Ask:

- Where are the servers located?

- Is content delivered through edge networks or centralized regions?

- Does the platform adapt performance based on user geography?

For global audiences, latency issues don’t show up in testing, they show up after launch.

Growth should be invisible to users

The best platforms scale without users noticing.

Look for:

- Auto-scaling infrastructure

- Load balancing across regions

- Graceful degradation instead of sudden crashes

If every growth phase needs manual intervention, the platform will slow your business down.

Stress testing beats promises

Ignore marketing claims. Ask for proof.

Request:

- Real case studies with user numbers

- Performance benchmarks under peak load

- Clear limits (because every platform has them)

Honest limits are safer than vague “unlimited scalability” promises.

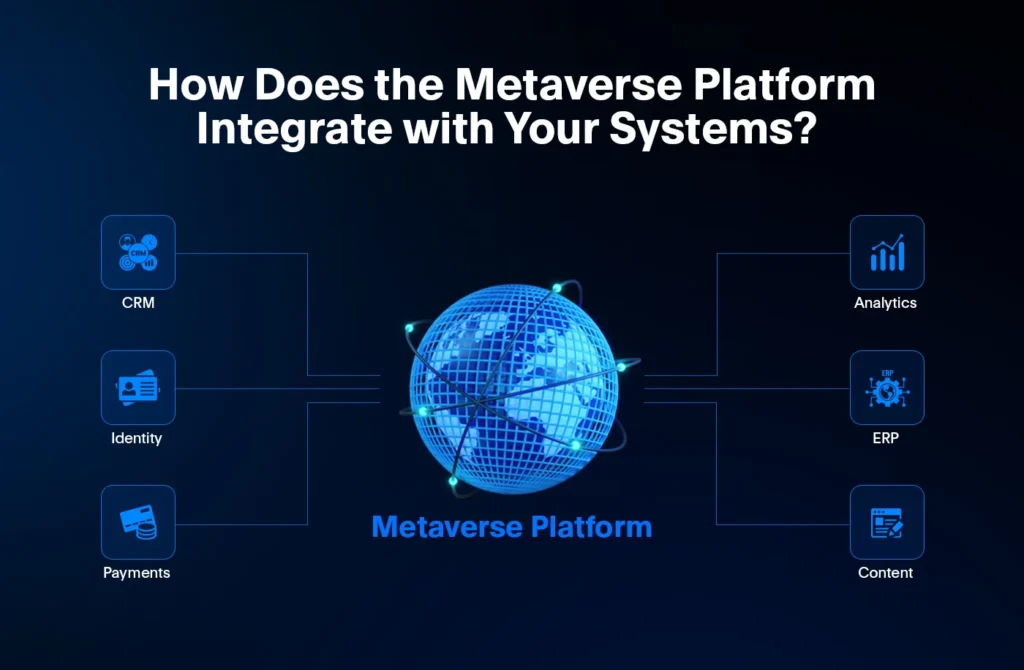

How Well Does the Metaverse Platform Integrate with Your Business Systems?

This is where many metaverse projects quietly fail, not at launch, but during integration.

A metaverse platform does not live in isolation. It must sit on top of your existing systems, talk to them cleanly, and not break daily operations. If integration feels like an afterthought, costs and delays follow.

Start with Core Business Systems

Before evaluating visuals or avatars, decision-makers should ask one simple question:

“What business systems must this platform connect with on day one?”

For most organizations, this includes:

- CRM and customer databases

- ERP, billing, or subscription systems

- Identity and access management (SSO, IAM)

- Analytics and reporting tools

Many platforms claim “easy integration” but rely on manual data syncs or limited APIs. That works for demos, not for real operations. A serious platform should expose well-documented APIs, webhooks, and event-based triggers that allow data to flow both ways in real time.

Identity, Access & User Data

A common blind spot is user identity.

If your customers already exist in your system, you should not be forced to recreate them inside the metaverse. The right platform supports:

- Single sign-on (SSO)

- Role-based access control

- Identity mapping between virtual users and real customers

This matters for compliance, analytics, and personalization. Platforms that control identity internally often lock you in and limit visibility. Businesses working with a metaverse development company should insist on identity ownership staying with them, not the platform.

Blockchain & Asset Compatibility

For platforms that include digital assets, NFTs, or tokens, integration goes deeper.

You need clarity on:

- Which blockchains are supported

- Whether assets can move outside the platform

- How wallets connect to your backend systems

A platform built by teams offering metaverse development services usually supports external wallets, custom smart contracts, and event tracking at the asset level. This becomes critical if you plan loyalty programs, virtual commerce, or secondary sales later.

Revenue, Costs & ROI: What a Metaverse Platform Really Makes

This section matters because this is where excitement meets reality. Many metaverse projects don’t fail due to lack of users, they fail because the revenue model was weak or the cost math was wrong.

Let’s break this down clearly, without fluff.

Revenue Options: What Actually Works

Not every revenue stream fits every business. The platform you choose should support your business model, not force you into trends.

What works in real deployments:

- NFTs with utility, not collectibles

NFTs tied to access, upgrades, memberships, or real benefits perform far better than art-only drops. Businesses working with an experienced nft token development company usually see higher retention when NFTs unlock something useful. - Access passes & gated experiences

Virtual events, private rooms, training zones, or premium networking areas convert well — especially in B2B and education-led use cases. - Virtual commerce (digital + physical)

The strongest models link virtual purchases to real-world value: product previews, reservations, limited editions, or loyalty rewards. - Brand sponsorships & space leasing

Effective only when user traffic is consistent. Empty virtual land has no sponsor value platforms often oversell this.

Key insight:

If a platform only supports “NFT sales” as revenue, it’s incomplete.

Cost Structure: Where Budgets Quietly Bleed

This is where many decision-makers get surprised six months in.

Here’s a clear cost breakdown most vendors don’t explain upfront:

| Cost Area | What to Check | Why It Matters |

| Platform Fees | Licensing, user caps, feature limits | Some platforms charge per active user |

| Blockchain Costs | Gas fees, minting, transfers | Volatile and often underestimated |

| Infrastructure | Servers, CDN, real-time rendering | Spikes during events or drops |

| Wallet & Identity | Custody, integrations | Impacts security and compliance |

| Ongoing Operations | Moderation, updates, support | Usually ignored in early budgets |

Platforms built by teams offering metaverse platform development company tend to be more transparent here because they’ve seen these overruns before.

Estimating TCO & ROI

Forget vanity metrics like “number of avatars created.”

Decision-makers should estimate Total Cost of Ownership (TCO) using a 12–18-month view:

- Fixed costs (platform, infrastructure)

- Variable costs (users, transactions, events)

- Operational costs (support, moderation, upgrades)

Now compare this against measurable outcomes:

- Revenue per active user

- Cost per engaged session

- Conversion from virtual interaction to real action (sale, signup, lead)

A good metaverse platform helps you measure these numbers, not guess them. If ROI tracking depends on spreadsheets and manual exports, scalability is already broken.

Security, Governance & Risk Control in Metaverse Platforms

When a metaverse platform moves from experimentation to real business use, security stops being a technical checkbox. It becomes reputation, compliance, and revenue risk.

What makes this harder is that metaverse platforms don’t behave like normal applications. They blend identity, payments, immersive interaction, and user-generated environments — all running in real time. That combination introduces risks many leadership teams don’t see until something breaks.

This section focuses on what actually goes wrong and how to evaluate platforms before that happens.

Why Metaverse Security Is Different

Metaverse platforms collect and process data most businesses have never handled before movement patterns, voice interactions, gesture tracking, and sometimes biometric signals from AR/VR devices.

According to cybersecurity research bodies, immersive platforms increase exposure to:

- Identity impersonation and account takeovers

- Asset theft through compromised wallets or smart contracts

- Social engineering attacks that feel “human” rather than digital

- Privacy violations tied to behavioral and sensory data

Unlike web apps, users don’t just click they exist inside these systems. That makes abuse harder to detect and easier to normalize if controls are weak.

Industry security groups, including ISC2, have already flagged immersive environments as higher risk due to expanded attack surfaces and identity ambiguity.

Security Controls That Actually Matter

Many platforms advertise “enterprise-grade security.” That phrase is meaningless unless you validate how it works in practice.

What decision-makers should insist on:

Continuous Identity Verification

Login-only security is not enough. Sessions should be monitored, re-validated, and limited by behavior and context, especially when assets or payments are involved.

Zero-Trust by Design

In metaverse environments, devices change, networks shift, and users move fast. A zero-trust model means:

- No default access

- Role-based permissions enforced in real time

- Automatic restrictions when behavior deviates from normal patterns

Academic research highlights zero-trust as essential for immersive and decentralized systems.

Asset-Level Protection

If a platform supports NFTs, tokens, or virtual property, it must show:

- Independent smart contract audits

- Transaction monitoring

- Clear rollback or incident response policies

Without this, asset loss becomes a “user problem”, which quickly becomes a business problem.

Governance: Who Is Accountable When Things Go Wrong?

Security controls protect systems. Governance protects businesses.

Strong governance answers uncomfortable but necessary questions:

- Who moderates abuse?

- Who investigates fraud?

- Who owns logs, evidence, and user records?

- Who answers regulators if something goes wrong?

Forward-looking governance models now recommend controlled anonymity, allowing privacy by default, with the ability to trace abuse when legal or policy thresholds are crossed. Ethical governance frameworks for immersive systems explicitly support this balance.

From a compliance standpoint, laws like GDPR still apply. Virtual presence does not reduce legal responsibility. Research published in peer-reviewed journals confirms that immersive environments remain subject to existing data protection rules.

If a platform cannot clearly explain how it handles audits, breach reporting, and regulatory requests, governance is weak, no matter how advanced technology looks.

Risk Control: A Practical Evaluation Checklist

Use this during vendor discussions. Vague answers here are red flags.

| Risk Area | What’s at Stake | What You Should Ask |

| Identity Abuse | Fraud, impersonation | How do you detect and stop account misuse during live sessions? |

| Data Privacy | Legal penalties | What personal and behavioral data do you store, and where? |

| Asset Theft | Financial loss | How are suspicious transactions flagged and handled? |

| Platform Attacks | Downtime, revenue loss | How do you protect against DDoS and service disruption? |

| Governance Failure | Brand damage | Who owns logs, investigations, and incident reporting? |

If answers rely on future roadmaps instead of current capabilities, the risk is already yours.

What This Means for Businesses

Security and governance are not technical details you “figure out later.” In metaverse platforms, they define whether you can scale safely or quietly accumulate risk.

A platform that treats security as a feature and governance as a policy document is not enterprise ready. The right platform treats both as operational foundations, not selling points.

Metaverse Platform Comparison

| Decision Factor | Off-the-Shelf Metaverse Platform | Semi-Custom Metaverse Platform | Fully Custom Metaverse Platform |

| Business Control | Platform dictates rules, limits, upgrades | Partial control, some vendor dependency | Full control over roadmap, rules, and features |

| Asset Ownership | Assets controlled by platform | Shared or limited on-chain ownership | Fully on-chain, business-owned assets |

| Revenue Models Supported | Fixed (basic NFTs, access fees) | Limited customization | Flexible (NFTs, passes, commerce, sponsorships) |

| Integration with Existing Systems | Basic APIs, shallow sync | Selective CRM / payment integration | Deep ERP, CRM, IAM, analytics integration |

| Scalability Control | Predefined user and traffic caps | Tier-based scaling | Architecture-level scaling control |

| Compliance Readiness | Generic policies | Region-specific support | Custom GDPR, enterprise, and regulatory handling |

| Data Ownership | Platform owns or controls data | Shared ownership | Full data ownership and export rights |

| Security & Governance Control | Platform-defined policies | Limited customization | Fully defined by business |

| Vendor Lock-In Risk | High | Medium | Low (portable data and assets) |

| Long-Term Cost Predictability | Low entry cost, rising over time | Moderate | High predictability at scale |

| Best Fit For | Short campaigns, experiments | Mid-term initiatives | Long-term business platforms |

How Minddeft Helps You Build a Metaverse Platform

Minddeft Technology Pvt Ltd works with businesses that want clarity before code. We help you decide what to build, why it matters, and how it fits your existing systems, before development begins. Our team has delivered blockchain-backed platforms where ownership, performance, and compliance actually hold up in real usage. We don’t push templates or hype-driven features. Instead, we focus on practical architecture, realistic costs, and long-term maintainability, so your metaverse platform grows with your business, not against it.

Hire Industry Experts

Hire Us NowGet started with Minddeft

today

Contact Us NowFrequently Asked Questions

Ask about their experience with platforms similar to your use case, tooling expertise (Unity, Unreal, blockchain frameworks), transparency in process, timelines, and how they handle security, integrations, and asset ownership. A reliable vendor should be able to explain these clearly and share past outcomes.

Make sure the vendor explains how they’ll connect the platform to your CRM, identity systems, payments, and analytics, with clear API strategies and real examples of prior integrations. This prevents expensive workarounds later.

Beyond core development, budget for ongoing API integration, maintenance, API updates, blockchain costs, and support. These often add up and can account for 15–25% of initial development annually.

Check if the architecture supports scalability, data portability, customizable revenue models, and multi device support. Early discussion about roadmap flexibility and future feature rollout is key.

Expect support for bug fixes, upgrades, new feature rollouts, monitoring, and performance optimization. The right developer should provide clear SLAs and a post launch roadmap for updates and training.