Centralized vs Decentralized Stablecoins: Understanding the Key Differences

5 min readSummary

Stablecoins help keep things steady in the crypto world, but not all of them work the same way. Centralized stablecoins, like USDT, are backed by real money held by a company, making them reliable but also vulnerable to regulations. On the other hand, decentralized stablecoins, like DAI, use smart contracts and crypto reserves to stay stable without a central authority, giving more freedom but adding complexity. This post breaks down their key differences so you can understand which one suits your needs best.

Introduction

Stablecoins are an important part of the cryptocurrency ecosystem, as they reduce volatility risk. It is divided into two main categories: centralized and de-centralized stablecoins. In this post, we are going to check the differences between the two to move ahead without any kind of confusion. Let’s get started

Stablecoin: An Overview

Stablecoins are digital assets that maintain price stability in relation to a specific asset. This is usually the US dollar. They act as a bridge for cryptocurrencies and fiat currency. Stablecoins are essential to the crypto market because they provide stability, and liquidity and facilitate transactions. Additionally, they play a significant role in advancing DeFi development by offering a stable medium for various decentralized financial applications.

Stablecoins have become increasingly important as the adoption of cryptocurrency grows. They reduce volatility risk for traders, investors, and businesses. Stablecoins have many advantages, including minimizing price fluctuation, allowing for low-cost transactions across borders, and generating interest in DeFi applications.

Now that you know what Stablecoin stands for, it is important that you understand the world of centralized and decentralized stablecoins. We have the answers for you in the next section.

Difference between Centralized and Decentralized Stablecoins

Stablecoins are broadly classified into centralized and decentralized stablecoins based on how they maintain stability and how the currency is issued. Centralized stablecoins are controlled by a central authority that manages the reserves and redemption mechanisms. In contrast, decentralized stablecoins employ algorithmic protocols, or crypto-collaterals, to maintain stability without depending on a central party.

What are Centralized Stablecoins?

Centralized stablecoins are pegged to real-world assets like the US Dollar and backed 1:1 by reserves maintained by the issuing central entity. This makes centralized stablecoins more stable and reliable, as trusted third parties guarantee their value. However, users have to trust the issuer’s ability to properly manage reserves and maintain the peg. Centralized stablecoins face counterparty risks if the issuer becomes insolvent or runs into legal issues. Some key features of centralized stablecoins include:

- Backed by fiat currency reserves held by a central organization

- Regulatory oversight of the issuer and reserves

- Redeem tokens for fiat currency from the issuer

- Centralized control can allow for rapid adjustments to the supply

Example - Tether (USDT): USDT is the largest stablecoin by market cap issued by Tether Limited. It is backed by fiat currency reserves, including USD, Euros, etc., held in bank accounts. Users can redeem their USDT for equivalent USD from Tether.

What are Decentralized Stablecoins?

Decentralized stablecoins maintain stability without relying on centralized intermediaries through algorithmic protocols or crypto-collateral. This makes them more censorship-resistant but also introduces complexities. Key aspects include:

- Collateralized by crypto-assets in decentralized reserves

- smart contracts and algorithms control supply dynamically

- Maintain stability through complex mechanisms like over-collateralization

- Fully transparent and open-source protocols

- No central entity controls the reserves

Example: Dai Stablecoin (DAI): DAI is generated by smart contracts on Ethereum and backed by collateral in Maker Vaults. Users can lock collateral like ETH and generate DAI loans up to 66.66% of the collateral value, maintaining sufficient over-collateralization to keep DAI stable.

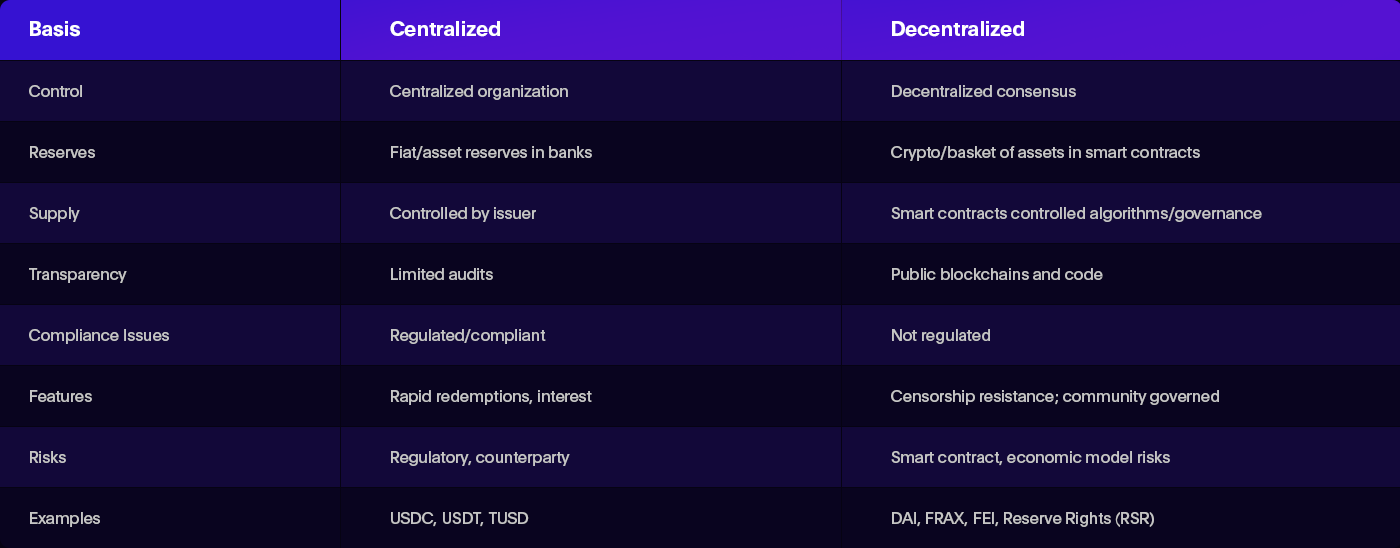

Tabular Differences:

A Detailed Comparison Between Centralized and Decentralized Stablecoins

Explore the key differences between the two to proceed ahead with complete clarity.

1. Reserve Transparency

Centralized issuers hold reserves in banks with limited public audits of reserve assets. In contrast, reserves of decentralized stablecoins are verifiable via smart contracts and block explorers with higher on-chain transparency.

2. Supply Control

Centralized issuers like companies directly control and regulate stablecoin supply. Meanwhile, the supply of decentralized stablecoins adjusts automatically based on economic incentives and algorithmic frameworks without corporate influence.

3. Redeemability

Centralized stablecoins offer instant redeemability of tokens into fiat currencies by issuers. Decentralized players lack direct convertibility, and redeemability depends on liquidity in decentralized exchange markets.

4. Stability Mechanism

Centralized stablecoins guarantee stability via fiat reserves. Decentralized systems rely on innovations like over-collateralization, algorithmic control, basket of assets, etc., to dynamically adjust supply and enforce stability.

5. Censorship Resistance

Due to lack of central authorities, decentralized stablecoin protocols have strong censorship resistance as no single entity controls the network. Centralized counterparts are vulnerable to regulatory sanctions and shutdowns.

Final Thoughts

So, both centralized and decentralized stablecoins aim to provide stable digital currencies for the growing crypto economy. Centralized versions offer instant redemption against fiat and regulatory oversight but have counterparty risks. Decentralized stablecoins are more censorship-resistant through open protocols but involve more complex reserve-backed mechanisms. The choice depends on one's priorities around control, trust, and stability. For those interested in stablecoin development, understanding these differences is crucial. All in all, stablecoins are poised to play a bigger role in facilitating the mainstream adoption of cryptocurrencies. Good luck!

Hire Industry Experts

Hire Us NowGet started with Minddeft

today

Contact Us NowFrequently Asked Questions

A stablecoin is a cryptocurrency that has a constant price, as opposed to other cryptocurrencies such as bitcoin and ethereum, which can have volatile pricing.

The famous example of decentralized stablecoin are Dai(DAI), sUSD(synthetiz USD) and USDX(USD stablecoin).

Exmaple of centralized coin are USDC (USD coin), USDT(Tether), and TUSD(TrueUSD).

Centralized stablecoins are controlled and issued by a central authority or organization, while decentralized stablecoins manage on the blockchain without the need for a central authority.

The selection between centralized and decentralized stablecoins is based on a variety of considerations, including project use cases, individual preferences, and laws and regulations.